IsoEnergy (TSX:ISO,OTCQX:ISENF) announced plans to acquire Anfield Energy (TSXV:AEC,OTCQB:ANLDF) on Wednesday (October 2), strengthening its position in the US uranium market.

The purchase will secure IsoEnergy’s access to two of the only three licensed uranium mills in the US, which it says will help solidify its reputation as a significant player in the domestic uranium market.

Anfield wholly owns the Utah-based Shootaring Canyon mill, as well as various uranium and vanadium projects across the Western US, including key areas in Utah, Colorado, New Mexico and Arizona.

A restart application has been submitted to increase Shootaring Canyon’s throughput capacity, and IsoEnergy already has a toll-milling agreement with Energy Fuels (TSX:EFR,NYSEAMERICAN:UUUU) at the White Mesa mill.

IsoEnergy and Anfield shareholders are set to respectively own approximately 83.8 percent and 16.2 percent of the combined company on a fully diluted basis, with each share valued at US$0.103 each.

According to IsoEnergy, the new entity will be a top player in terms of uranium resource ownership.

When IsoEnergy and Anfield’s assets are amalgamated, they will together have a mineral resource of 17 million pounds in the measured and indicated category and 10.6 million pounds in the inferred category. They will also have a historical mineral resource of 152 million pounds measured and indicated, and 40.4 million pounds inferred.

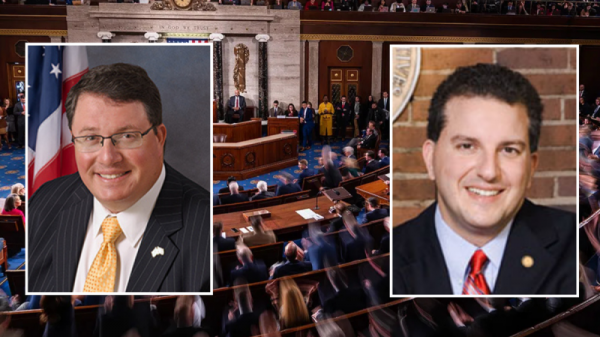

IsoEnergy CEO Philip Williams emphasized the strategic importance of the acquisition.

“The US is a key jurisdiction for us, and we believe today’s acquisition of Anfield strengthens both our resource base and near-term production potential,’ he said in the company’s press release.

The proximity of Anfield’s assets to IsoEnergy’s projects, particularly the Tony M mine, which is located just 4 miles away, is expected to reduce transportation costs and increase flexibility in mining and processing operations.

The combination also provides operational synergies, with projects including Velvet-Wood and Slick Rock offering advantages through shared infrastructure and reduced administrative costs on a per-pound basis.

The acquisition aligns with broader industry trends favoring nuclear energy as a reliable and carbon-neutral power source. Rising support for nuclear energy is driving increased uranium demand globally, and IsoEnergy believes the Anfield deal positions the company to meet this growing demand through its expanded production capacity.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.